Cyrille E. Urfer

Chief Investment Officer at The Forum Finance Group SA | Geneva | Switzerland- Claim this Profile

Click to upgrade to our gold package

for the full feature experience.

Topline Score

Bio

Experience

-

The Forum Finance Group SA | Geneva | Switzerland

-

Switzerland

-

Financial Services

-

1 - 100 Employee

-

Chief Investment Officer

-

Jun 2023 - Present

Geneva, Switzerland

-

-

-

Unigestion

-

Switzerland

-

Financial Services

-

100 - 200 Employee

-

Head of Sovereign Wealth Funds & Institutional Clients Middle East

-

Oct 2018 - May 2023

Geneva Area, Switzerland

-

-

-

Public Investment Fund (PIF)

-

Saudi Arabia

-

Financial Services

-

700 & Above Employee

-

Head of Global Public Markets

-

Jan 2017 - Jun 2018

Riyadh Head of Global Public Markets: • Formulated strategic plan for Global Public Markets department, which aims to leverage investment and knowledge transfer le rise of investments managers and graille build internal research, investment, and execution capabilities. • Managed bonds, stocks and hedge fund portfolios playing key role in KSA’s plan to build PIF into a financial power-house that drives economy’s transformation and ends over-reliance on oil. • Drafted… Show more Head of Global Public Markets: • Formulated strategic plan for Global Public Markets department, which aims to leverage investment and knowledge transfer le rise of investments managers and graille build internal research, investment, and execution capabilities. • Managed bonds, stocks and hedge fund portfolios playing key role in KSA’s plan to build PIF into a financial power-house that drives economy’s transformation and ends over-reliance on oil. • Drafted governance structure for the asset classes; initiated manager and strategy due diligence for strategic partner, leading investment manager and co-investment/direct investment initiatives. • Engaged in research projects with asset managers, and index providers on factor investing and specifically on quality investing as a sustainable investment approach for long-term investors. • Represented PIF at One Planet Sovereign Wealth Fund Working Group, an initiative by the French president, aiming to accelerate efforts to integrate financial risks and opportunities relative to climate change in the management of large and long-term pools of capital. Show less

-

-

-

Gonet & Cie SA

-

Switzerland

-

Banking

-

100 - 200 Employee

-

Chief Investment Officer - Head of Asset Allocation

-

Mar 2012 - Dec 2016

Geneva Area, Switzerland Headed asset allocation for the Investment Committee. Analyzed asset class behaviors and expanded cross-asset offerings. • Advised relationship managers and clients on investment strategy and decisions. Strengthened client relationships via in-person visits with client representatives. • Chaired process for selecting third party products, conducted research and due diligence, formulated investment recommendations, and monitored all investments.

-

-

-

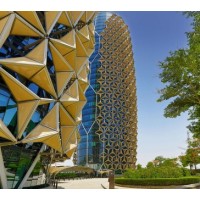

Abu Dhabi Investment Council

-

United Arab Emirates

-

Investment Management

-

200 - 300 Employee

-

Chief Investment Officer for Equities and Fixed Income (EFI)

-

Jul 2008 - Aug 2011

Abu Dhabi Sovereign Wealth Fund and Investment unit of the Government of Abu Dhabi. Brought on board to build an entire EFI management infrastructure for ADIC, which was established in 2007. Recruited a highly effective team. Leveraged expertise in asset allocation, manager research, and portfolio management. • Led a team that generated investment themes, conducted manager searches, performed due diligence, and made investment decisions. - Replaced all of the existing Index… Show more Sovereign Wealth Fund and Investment unit of the Government of Abu Dhabi. Brought on board to build an entire EFI management infrastructure for ADIC, which was established in 2007. Recruited a highly effective team. Leveraged expertise in asset allocation, manager research, and portfolio management. • Led a team that generated investment themes, conducted manager searches, performed due diligence, and made investment decisions. - Replaced all of the existing Index Managers (60% of portfolio) and transitioned to a high-conviction portfolio, which included activist and absolute-return managers. • Generated a consistent risk-adjusted return that exceeded the policy composite benchmark. - Ranked in the upper quartile of comparable funds (US Endowment universe). Achieved excellent results via to strategic allocation, high-quality research, and smart manager selection. • Participated as anchor investor for launch of new investment funds, including distressed credit opportunities, high yield emerging market debt, and sustainable Asian equities. • Appointed to ADIC’s Investment Committee and assessed investments that competed for capital. Show less

-

-

-

Lombard Odier Group

-

Switzerland

-

Banking

-

700 & Above Employee

-

Head of Private Asset Management

-

Jan 2008 - Jun 2008

Geneva, Switzerland LODH: Privately owned financial services firm that specializes in asset management and estate planning - $174bn AuM and operations in 17 countries. Promoted to Head of Private Asset Management (2008) Promoted to Executive VP, Head of Fund Research and Multi-Asset Management (2004–2008) Promoted to Senior VP, Head of Financial Intermediaries and Asset Management (2002–2008) During 2002-2008, LODH reorganized numerous times to improve internal efficiencies, scale up its… Show more LODH: Privately owned financial services firm that specializes in asset management and estate planning - $174bn AuM and operations in 17 countries. Promoted to Head of Private Asset Management (2008) Promoted to Executive VP, Head of Fund Research and Multi-Asset Management (2004–2008) Promoted to Senior VP, Head of Financial Intermediaries and Asset Management (2002–2008) During 2002-2008, LODH reorganized numerous times to improve internal efficiencies, scale up its asset base, and respond faster to market forces. Promoted twice. Assigned additional and progressively challenging roles each year. Ultimately took charge of all fund research and asset management for private clients. • During 2003–2008, created, developed, and implemented the External Manager Research Process, which ultimately drove an additional $12bn AuM – and achieved higher profitability than the hedge-fund activities. - Increased the LODH profile. Achieved personal recognition as one of Europe’s Top Fund Selectors. - Created new single and multi-manager funds. Negotiated exclusive and strategically important partnership deals with partners such as Generation LPP (Al Gore, Chairman). • As head of the newly created Private Asset Management Department (2008), led a team of 35 investment professionals that controlled a total of more than $20bn of multi-asset class portfolios and funds. • Appointed to the Investment Board and sourced ideas for investments. Actively participated in tactical asset-allocation decisions for private clients and financial intermediaries. • Directly managed multi-manager funds – for example, LODHI Healthcare Expertise, and LODHI World Gold Expertise – as well as Fund of Funds (FoF) such as LODH MF Commodity.

-

-

Head of Fund Research and Multi-Management

-

Jan 2004 - Jun 2008

Geneva, Canton of Geneva, Switzerland

-

-

Head of Financial Intermediaries

-

Feb 2001 - Jun 2008

Geneva, Canton of Geneva, Switzerland

-

-

International Team Leader and Senior Portfolio Manager

-

Feb 1998 - Jan 2001

Geneva, Switzerland Vice President and Portfolio Manager | International Team Leader (1998–2001) Brought on board to update the private banking operations, particularly for overall organizational design and management of individual accounts. • Promoted in 2000 and began leading the transition to centralized asset management, similar to the transition at Credit Suisse during 1993–1998. • Managed a newly formed, three-person team with two concurrent roles: - Private Client Portfolios:… Show more Vice President and Portfolio Manager | International Team Leader (1998–2001) Brought on board to update the private banking operations, particularly for overall organizational design and management of individual accounts. • Promoted in 2000 and began leading the transition to centralized asset management, similar to the transition at Credit Suisse during 1993–1998. • Managed a newly formed, three-person team with two concurrent roles: - Private Client Portfolios: Strategic and tactical allocation - CHF portfolios - and the firm’s flagship fund. - Financial Intermediaries: Asset Management for multi-asset, fund-of-funds (FoF) type portfolios for Swiss and European institutional clients and intermediaries (for example, created a range of investment solutions for insurance companies and regional banks). Supervised fund management and reporting. • Personally managed LO Opp Global Balanced Fund, $420M AuM flagship mutual fund, which won the prestigious Lipper Award and implemented a similar strategy to the institutional side. • Began research and due diligence on managers, setting the stage for future projects at LODH and ADIC.

-

-

-

Credit Suisse

-

Switzerland

-

Banking

-

700 & Above Employee

-

VP and Portfolio Manager, Private Banking

-

1990 - 1998

Geneva, Switzerland Global financial services company $1.2tr assets and operations in 50 countries Achieved a major – and unusually early – promotion to VP, based on exceptional client-relationship skills and strong performance on the asset-centralization project. Led a six-person team that ran the Private Client Portfolio (total value more than $1bn). Focused on CHF tactical asset allocation and US equity research • Led team that established uniform management of discretionary mandates across… Show more Global financial services company $1.2tr assets and operations in 50 countries Achieved a major – and unusually early – promotion to VP, based on exceptional client-relationship skills and strong performance on the asset-centralization project. Led a six-person team that ran the Private Client Portfolio (total value more than $1bn). Focused on CHF tactical asset allocation and US equity research • Led team that established uniform management of discretionary mandates across different branches, reference currencies, and strategies (the consolidated portfolio was tailored for fixed income and equities) • Played key leadership role on several investment committees. Led development of a unique and highly successful methodology for strategic asset allocation, tactical execution, and implementation - New strategic asset allocation methodology was tested in Geneva and became so successful that it was quickly rolled out for all CS private banking throughout Switzerland. - Used the new methodology to design a custom-tailored portfolio – 80% fixed income and 20% equities – for an Ultra-HNW individual with $500m assets. Associate, Regional Branch Supervisory Assistant, Geneva, CH (1990–1991) - Bank Apprenticeship, Geneva and Zurich, CH (1985–1989) • Rotated through various departments during a comprehensive apprenticeship program. Acquired expertise in Private Banking while completing apprenticeship and a formal diploma program in banking and economics. Assigned to the Stock Exchange Department – trade settlements and back office – for one year. • Showed exceptional talent for relationship building with the internal Private Bankers and high-net-worth clients. • Assigned to an urgent project in 1992 – the centralization of asset management for all CS branches in Geneva – and collaborated closely with the heads of nearly 30 bank branches in Geneva. Contributed a key leadership role during team building for the newly formed asset-management group. Show less

-

-

Education

-

IMD Business School

Executive MBA, Business Administration and Management, General -

CFA Institute

Chartered Financial Analyst (CFA), Financial Analysis -

1996 - 1997

AZEK - The Swiss Training Centre for Investment Professionals

Analyste Financier et Gestionnaire de fortune, Financial Analyses & Wealth Management -

1990 - 1993

SFI Swiss Finance Institute

Diplôme d'expert en économie bancaire, Banking

Community